Attracting Interest

Holland Homes Inner Circle - Issue 14

As a young father, I want to give my kids the same opportunities my parents gave my sister and me—introduce them to sports, foster a love for learning, and support their interests, whatever they may be. What it doesn't include is pushing them around in Lamborghini’s limited edition $5,000 baby stroller.

While depriving my kids of this luxury might be 2025-style parental negligence, I just don’t think I can keep up with this stroller's need for speed.

Speaking of not driving anywhere: 500,000 fewer Canadians crossed the U.S. border this February compared to last year. Trump's economic blitzkrieg is undoubtedly a factor, with both countries feeling the impact. Our depreciating dollar doesn’t help either. And if further proof is needed of the strained Canada-U.S. relationship, the American national anthem is still getting booed at Leafs games.

Side note—while I’m more optimistic about the Leafs’ roster construction this year than in the last five, I still have my doubts about their ability to make it past the second round. Of course, I’d love to be proven wrong.

In other economic news, the U.S. Fed decided to pause rate cuts, leaving their policy rate at 4.25%–4.50%. This is miles away from Canada’s 2.75%, but rate cuts are expected from the Fed this year. Inflation will largely dictate what happens next—lowering rates could reheat prices even if the economy struggles. And as I touched on in my last post Grounded Reality, BoC Governor Tiff Macklem has emphasized there’s no easy fix for higher inflation paired with weaker demand—a byproduct of tariffs.

For those opting for variable-rate mortgages, this uncertainty should not be understated. A recent Financial Post article noted that 36% of borrowers in February chose to float their rates, hoping to capitalize on further cuts. However, if inflation resurges and rate direction reverses, these borrowers could face a harsh reality. It’s vital to have expert financial advice from a mortgage specialist when navigating this market.

Is real estate finally heating up after seven consecutive rate cuts from the BoC? A colleague listed a starter home in Durham last week, and his stats are eye-opening: 50 groups through the open house, 63 total showings, 9 competing offers, and it sold $120,000 over list. Granted, they listed low to hold offers, but it still sold $40,000 over my colleague's optimistic expectations. I don’t want to overstate this as a market-wide trend, but entry-level homes are definitely attracting interest—I too recently found myself in a competing offer situation with a first-time homebuyer.

On a policy note, Prime Minister Mark Carney has officially scrapped the carbon tax, which was set to increase on April 1st. While we might see some relief at the pump and in heating bills, experts don't expect grocery prices or other goods to drop. Carney also plans to erase GST on all homes up to $1 Million for first-time homebuyers. Convieniently, both of those directives were campaign items for Pierre Poilievre of the Conservatives. A snap election appears to be on the horizon as the Liberal Party is regaining ground.

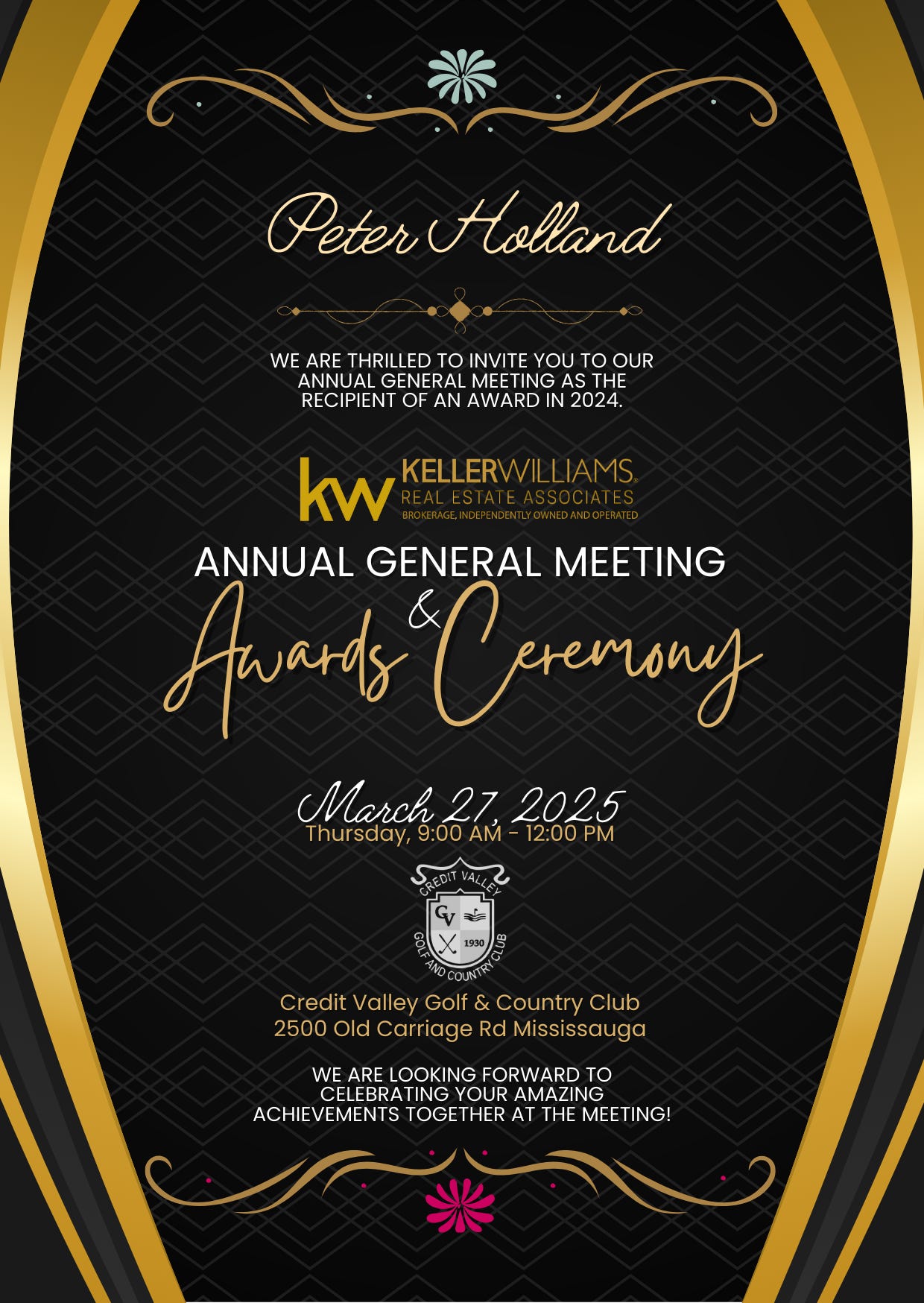

On a personal note, Holland Homes is set to receive an award at our brokerage’s annual ceremony next week.

We’re in business to help our clients achieve their goals, and being recognized for accomplishing ours also feels good.

To end on a light note—and because MLS listing photos are too entertaining not to share—find yourself an agent who uses photos without their finger in the corner!

Thanks for reading!