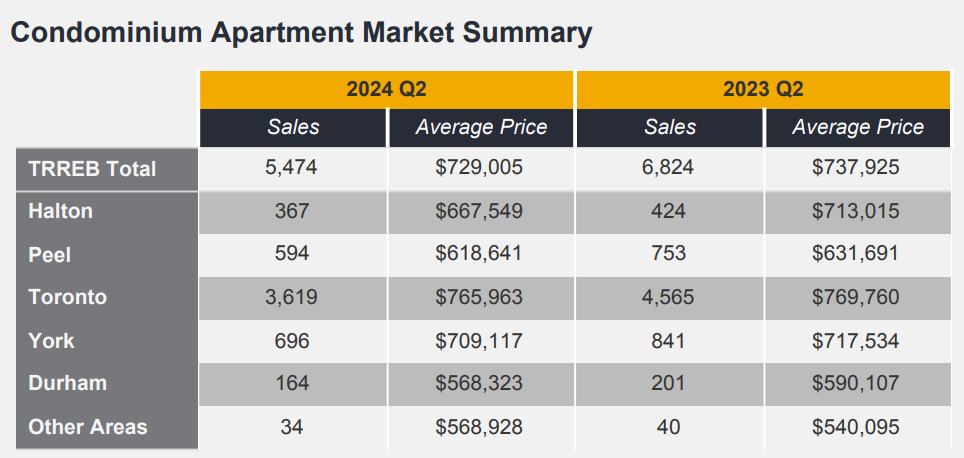

Sales in the Toronto condo market are down 26% YoY, despite nearly double the inventory. Yikes. Here's a quick snapshot of that inventory:

And that’s just in the downtown core. No wonder we’re seeing headlines like this:

Yet, despite the surge in listings, the average sales price has been surprisingly resilient—down only 0.5% YoY in Toronto.

This is good news if you're selling, but it begs the question: is this sustainable? How long can sellers hold firm on their asking prices before surrendering to market dynamics and mortgage renewal timelines? Everyone’s situation is unique, but if you're a buyer, the math has to work. And based on what I’m about to show you, something's got to give.

Let’s break it down:

A buyer purchasing an average Toronto condo for $765K puts down 20%, meaning they’ll finance approximately $613K. With BMO currently offering a 5-year variable rate at 5.95%, the buyer will be paying $36,473 per year on interest alone—nothing toward principal, no equity building, just interest.

Now compare that to renting. A two-bedroom condo like this can rent for around $3,200 per month, or $38,400 per year. No ownership headaches, no property taxes, no maintenance fees—just a simple rental payment. You could even split the cost with a roommate.

When you factor in the additional costs of ownership—property taxes, maintenance fees, and the usual headaches—renting turns out to be the more affordable option.

And honestly, how many people who scrimped and saved $150K for a downpayment, plus the hefty Toronto double land transfer tax, are eagerly saying, "Yes! I can finally buy that 700 sq. ft. box in the sky. Quick, Peter, sign me up for a Buyer Rep Agreement so I can start the search!"

Is it obvious I live in the suburbs? You definitely can’t spend 13 hours bonding with your dad while building one of these suburban wonderlands if you don’t.

Bottom line: The numbers don’t work for buyers, and they don’t work for investors either. Landlords across the province facing steep mortgage renewals are forced to get creative just to make the math work.

Check out these two examples:

I can only imagine the listing description: “Your very own shared space! Outlets are first come, first served. The mattress closest to the light switch is an extra $50, and passing gas is encouraged under the blanket or outside. Act fast, this offer won’t last.”

Or this: “Only for girls” rental listed by a male landlord in Brampton, with the eyebrow-raising Rental Option 3.

Sadly, there’s real demand for these types of rentals…

Affordability has to change, but where that change comes from is yet to be seen. Although, two forces are already in play:

The Bank of Canada, with three consecutive rate cuts, is clearly pulling levers to “help.”

Some sellers will be forced to capitulate (which is rough for them), but ultimately, this might be healthy for the broader market.

On the bright side, even if you’re selling in this tough market, there are strategies to attract buyers without slashing your list price.

I certainly have enough material to continue but I’m going to save some keystrokes for another post.

I appreciate all your feedback from Issue #1 and that’s a wrap for Issue #2.

Thanks for reading!