As I sit here watching my text cursor flash, trying to summon the antidote for writers block, I can hear my wife reading a goodnight story to my 3 y/o daughter, Liv. Tonights feature is ‘Twas the Night Before Christmas—it probably will be for the next 30 some odd bedtimes leading up to the big day. And while this is by far my favourite holiday, our government must be seeing some concerning data because HST will also be getting some time off.

Goods that will see a reprieve include, but are not limited to: alcoholic beverages less than 7% potency, candies, salty snacks, prepared food, children’s diapers and toys, printed books, Christmas trees, and much more. Check out a more comprehensive list HERE. The relief period will be from Dec 14 to Feb 15th.

Maybe I’m jaded, but all I can think is 'what new tax will this Liberal government impose to offset the $1.6 Billion they’re about to forgo in tax revenue’?

Also, let’s pause to appreciate the irony of the Liberals ‘axing a tax’ while the opposition is simultaneously calling for an axe the tax election. It’s likely Trudeau will be eating some humble pie this Christmas. However, HST break or not, pie is a luxury many won’t be able to afford as food banks continue to see record demand. Justin’s 2021 “you’ll forgive me if I don’t think about monetary policy” quote is not aging well and there’s lots of struggling Canadians who likely don’t forgive him.

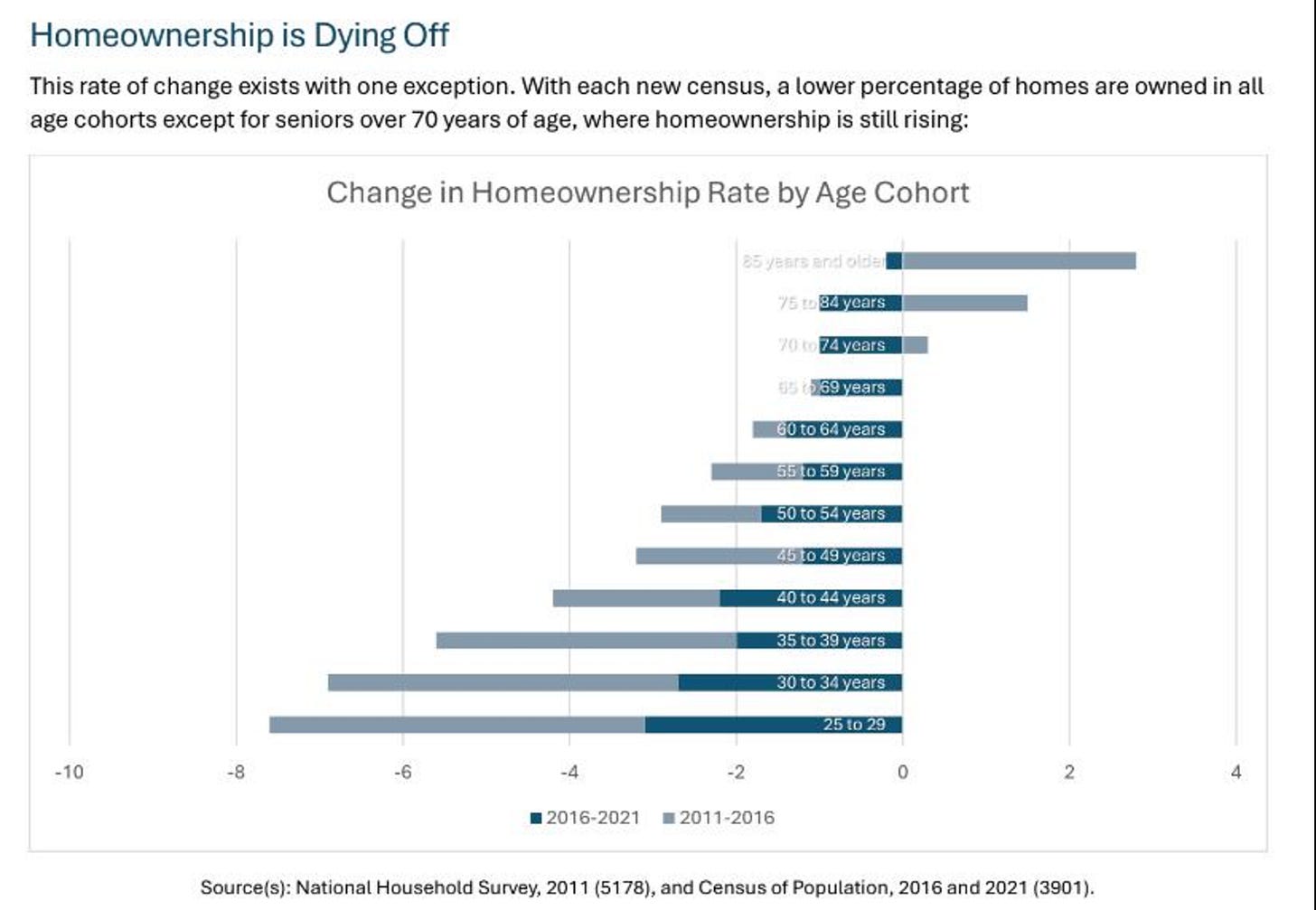

Speaking of the budget not balancing itself, this chart depicts the demise of homeownership:

The only increase in home ownership is for the 70+ demographic... Not even condos, which can be one of the most affordable entry points for ownership are attracting buyers yet; Despite large inventory and untold numbers of price reductions. While October home sales were up 30% year-over-year from 2023, the condo market starkly contrasts with an 84% decline in sales—91% lower than the 10-year average. Wowzers. This divergence highlights how investors have largely driven condo demand and they are fleeing for the exit now that the numbers don’t pencil out. Only time will tell if mortgage rule changes, lower interest rates, and price declines will eventually lead to condos catching a bid. But for those looking to buy, this could be an opportunity to enter at a more favourable price point with long-term growth potential.

There are five humbling stories in the article below discussing Toronto’s cost of living crisis.

Even the 407 highway is joining the higher price crusade. Starting January 1st, drivers will notice an increase of 3 - 14 cents per km depending on the time of day and zone travelled in. The 407 anticipates the average monthly bill will see an increase of approximately $8. Which may not sound like much, except 1 in 10 Torontonians are already on their way to the food bank… For a full breakdown of 407 pricing and zones, click HERE.

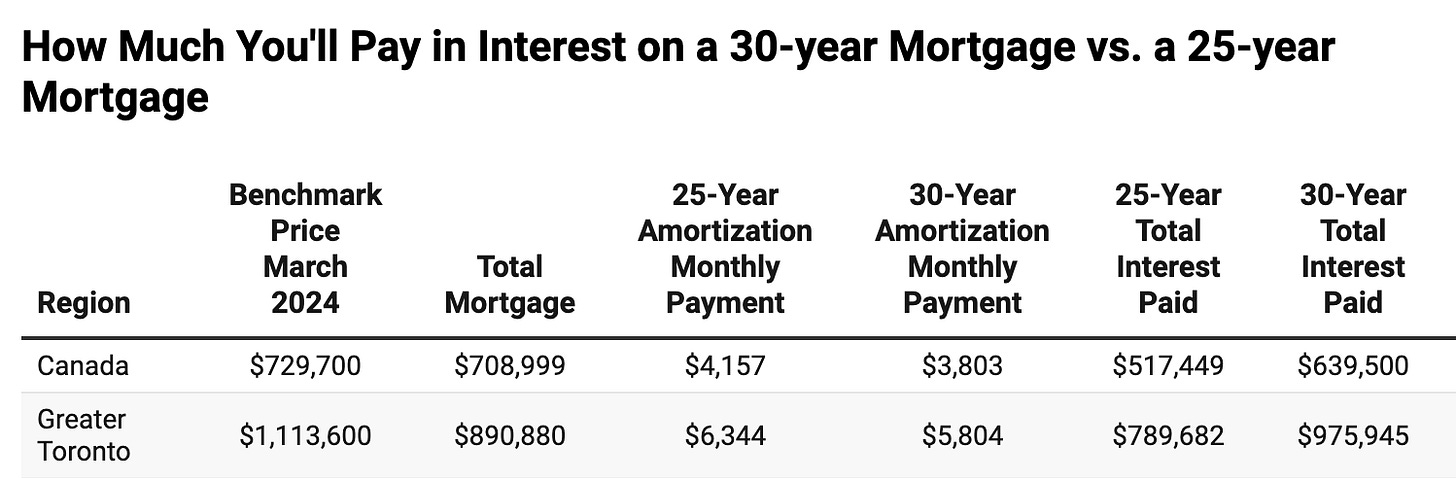

I believe we’re in a bit of a pickle when it comes to affordability—policies aimed at spurring demand, however well intentioned, don’t always result in less of a financial burden. For example, the policy which extends insured mortgages from 25 to 30 years lowers monthly payments by ~$500, but the additional interest cost of those 5-years is $200k!!

I worry consumers don’t think about the implications, or perhaps they don’t care because we live in such a debt based society that it isn’t the total cost they consider, but rather how much can be afforded right now. A realtor at the same brokerage as Holland Homes recently did a survey where they asked, "Would you rather have a higher monthly payment but a lower purchase price, or a lower monthly payment and a higher purchase price”? The results reflected a common pitfall in financial decision-making—focusing on immediate affordability rather than long-term savings. Sigh. How else can you keep up with the Jones’ though, am I right?

For anyone navigating these complex decisions, working with a professional who understands the full financial picture is crucial.

Holland Homes was recognized by our brokerage in consecutive months for being a top producing team. We remain grateful to our clients for their trust.

Finally, as I continue integrating my past hockey career with my current real estate business, I practiced with the Vaughan Rangers U12 A team this week.

Funny enough, I was invited out by a Dad that I met during a June door-knocking escapade. And of the 500 questions I got asked at the practice, “Are you going to buy my Dad’s house?” was the funniest one to answer.

Thanks for reading!