Just when I thought I’d seen it all, there’s a new app in New York and L.A. that lets you hire armed security transportation. Basically, it’s ‘Uber with guns’. Your driver is a military, law enforcement, or special forces veteran—and yes, they’re packing. While Protector is more about safety than a quick ride to Starbucks, I can only hope it makes its way to Toronto in 15 years, when my daughter Liv starts dating.

And if that wasn’t enough internet for one day, here’s another gem: Qatar airlines made a man sit next to a deceased passenger for 4 hours while flying from Melbourne to Venice. His wife got moved to an open seat, but he was stuck, presumably contemplating the in-flight meal options while side-eyeing his seatmate. A medical emergency may have warranted an emergency landing, but clearly the airlines policy for someone already dead is to ensure all breathing passengers make their connections.

As tragic as it is, it’s very rare—statistically 1 in every 3.2 million passengers crosses into the afterlife at 30,000 feet.

Okay, awkward pivot…

Real Estate!

As always, I’m deep in listings, filtering properties for clients and analyzing valuations. What never ceases to amaze me is the number of listing photos that look like crime scene evidence. But every now and then, I come across one on the other end of the spectrum that makes my day.

What a good boy.

And for contrast, this is what not to do:

Dinner ingredients scattered across the counter, compost piled up, cabinet doors open, dishes stacked to the ceiling… sorry, you want HOW MUCH?

Seriously, how do sellers (and their agents) think buyers will be interested after seeing this?

Fun fact: 71% of licensed Realtors didn’t sell a single home last year. That means if you pick an agent at random, there’s a good chance they closed exactly 0 deals. This business requires (among many other things) skill and strategy. Leaving one of your largest financial assets in the hands of your neighbour’s hairdresser’s dog walker? Probably an expensive decision.

Market Snapshot

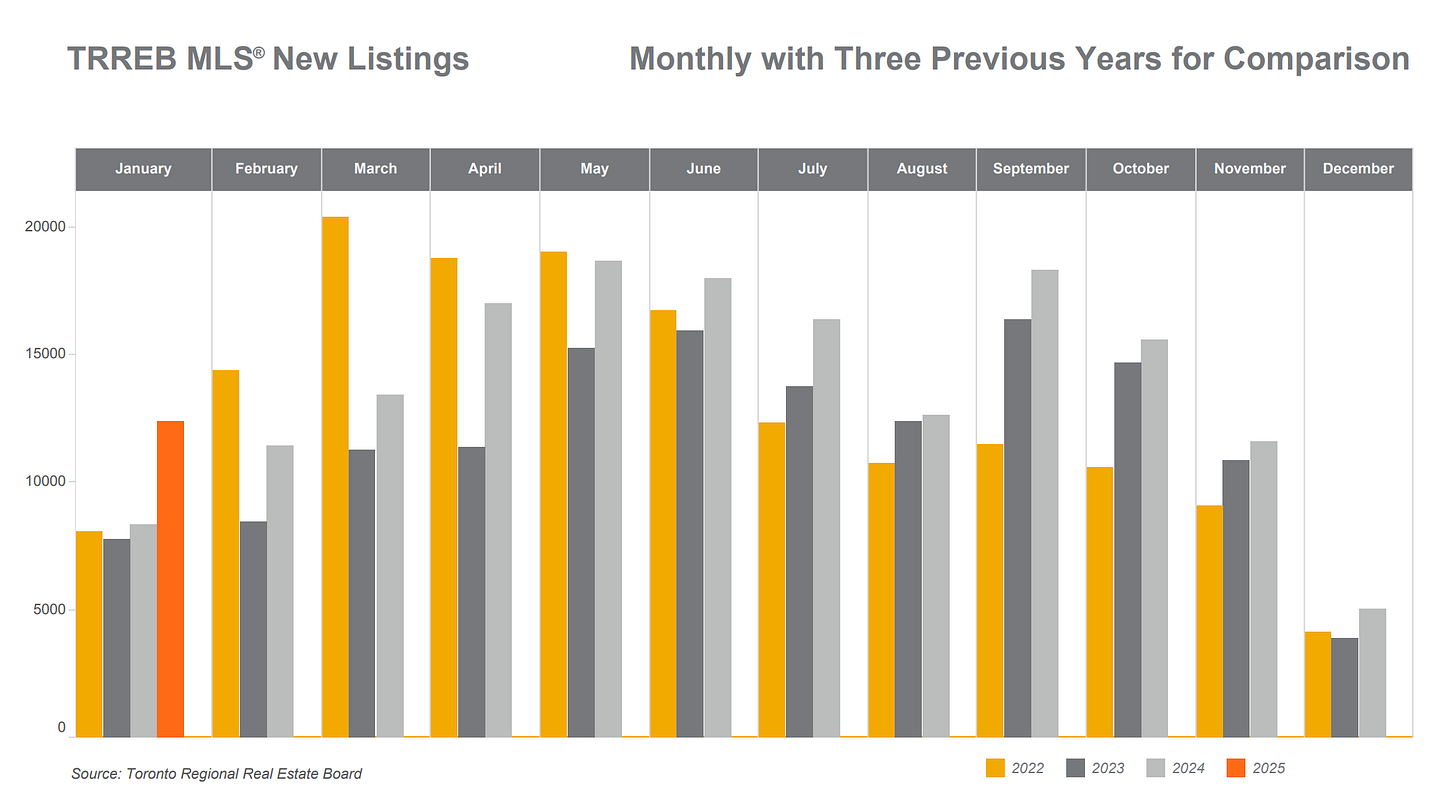

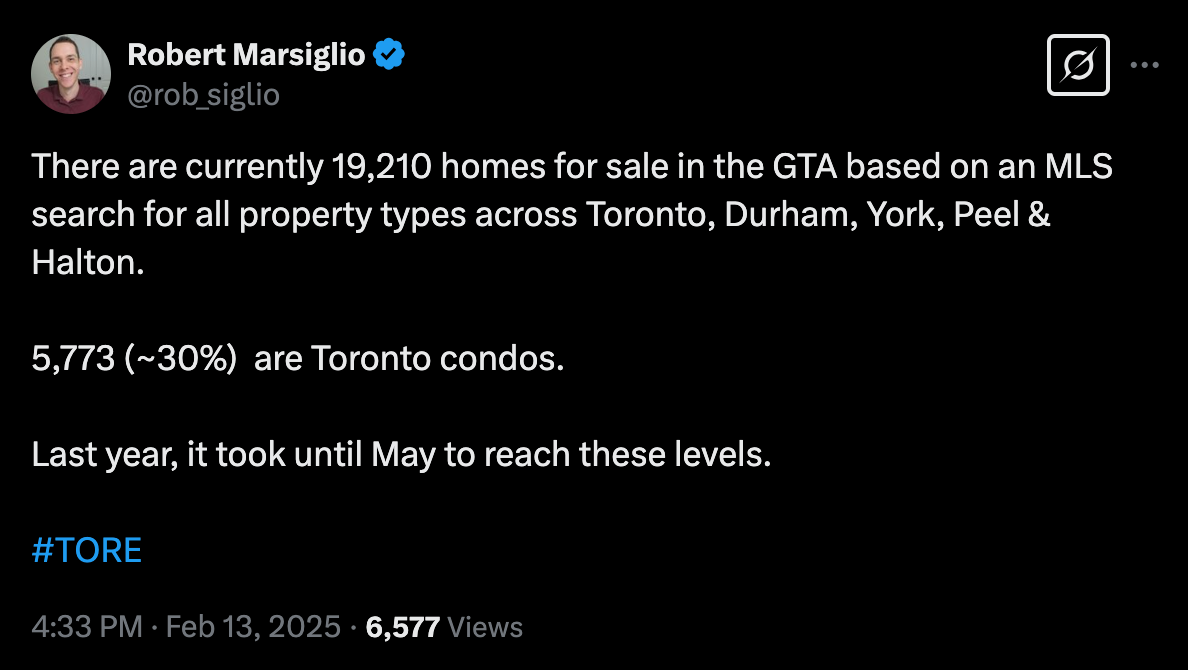

The January orange candle shows how quickly sellers have jumped into the 2025 market compared to the past three years. February’s numbers will be in soon and I expect listings to remain elevated—especially as we head into the spring market, which is historically the busiest time of year.

Year-over-year, prices have edged up 1.5%. But with rising inventory and cautious buyers, the supply and demand balance will be key to watch.

The Tariff Problem

Since real estate values are closely tied to interest rates, tariffs are worth keeping an eye on. Why? Because they can push inflation higher while simultaneously reducing demand—a nasty combo which the Bank of Canada has no real solution for.

Tiff Macklem (BoC Governor) pointed out that inflation is back near 2%, meaning the Bank is better positioned to stabilize the economy. But there’s a catch: tariffs could wipe out Canada’s economic growth for the next two years. And the Bank doesn’t have a magic fix for high inflation paired with weak demand.

To make matters worse, the Canadian dollar keeps losing value, making everything we import from the U.S. more expensive.

Of course, doom-and-gloom housing crash headlines will always grab attention, but let’s step back and also consider some grounded reality:

People need places to live.

There’s a floor to price drops. Eventually, investors step in when rental math starts making sense.

Canada—flaws and all—is still a highly desirable place to live, meaning demand isn’t vanishing anytime soon.

Wrapping Up

After a number of failed attempts (thanks to daycare germs and scheduling conflicts) Sasha and I finally got our family photos done. This one’s a favourite, and also one of the few where Chase wasn’t screaming.

Family is everything to us, and that’s why our real estate approach is family-first.

Whether you’re buying or selling, you need the right strategy and the right guidance. You know where to find me:

📩 pholland@kw.com

That’s it for issue (lucky) number 13. Thanks for reading!